What Is The Vix Stock. Investors can trade ETFs that track the VIX in order to speculate on or hedge. The VIX volatility index offers insight into how financial professionals are. The VIX or the volatility index is a standardized measure of market volatility and often used to track investor fear. The Volatility Index VIX measures differences between prices on future calls and puts.

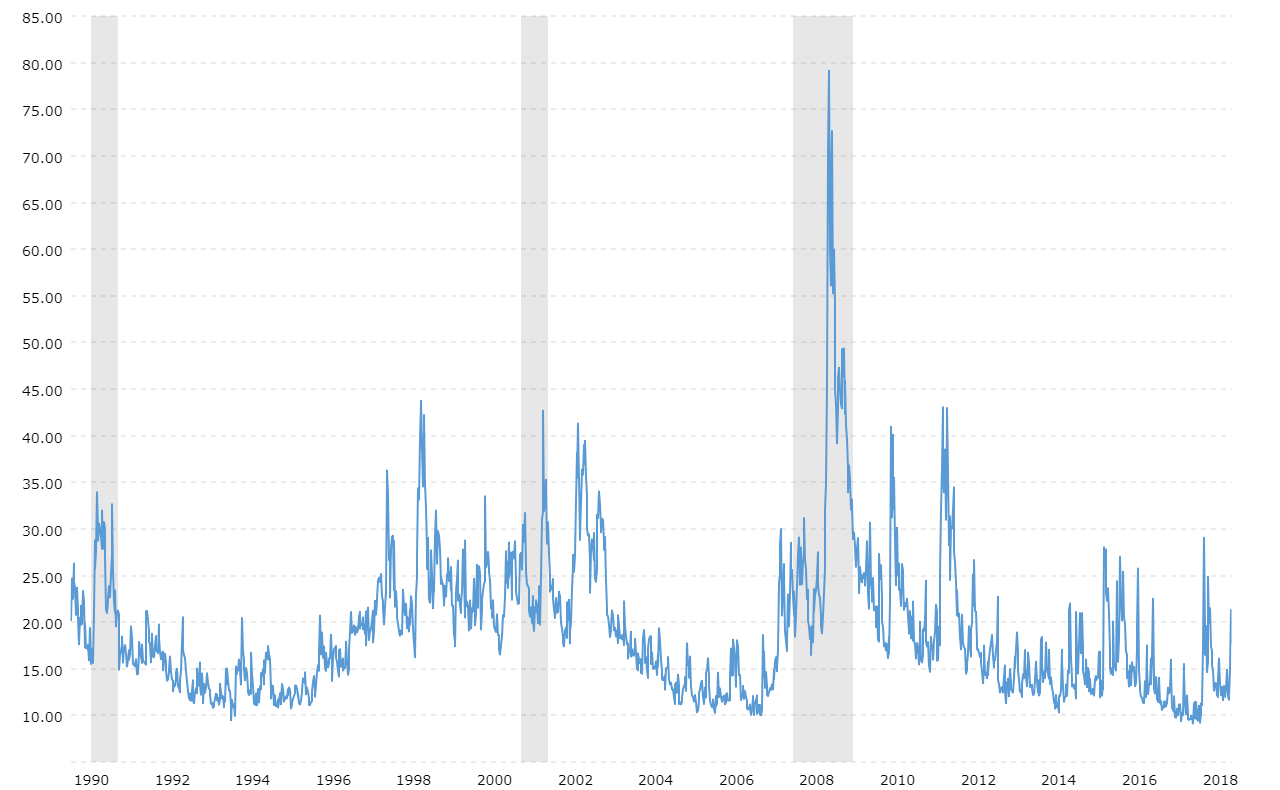

Investors who want to get a read on stock market sentiment can turn to the CBOE Volatility Index or VIX to interpret patterns of expected future volatility before making investment decisions. The price is derived from the SP 500 index and provides a measure of market risk and investors sentiment. Yet its been just 10 months since the stock wipeout that sent the VIX soaring to a record. The Volatility Index VIX measures differences between prices on future calls and puts. The CBOE Volatility Indexalso known as the VIXis a primary gauge of stock market volatility. VIX is a volatility index commonly referred to as the fear-index.

Its just the 11th time weve seen this type of spike.

The VIX volatility index offers insight into how financial professionals are. Yet its been just 10 months since the stock wipeout that sent the VIX soaring to a record. Investors who want to get a read on stock market sentiment can turn to the CBOE Volatility Index or VIX to interpret patterns of expected future volatility before making investment decisions. The Cboe Volatility Index or VIX is a real-time market index representing the markets expectations for volatility over the coming 30 days. The CBOE Volatility Indexalso known as the VIXis a primary gauge of stock market volatility. Like stocks the VIX can technically go to zero although the likelihood is minuscule.