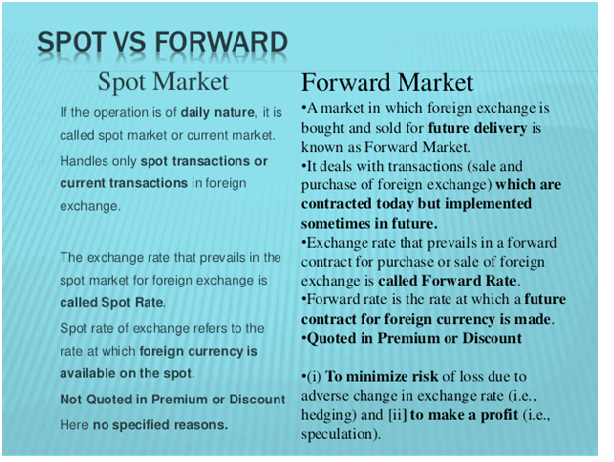

Spot And Future Market. But we havent really mentioned until now that according to their point of settlement markets can be spot markets and futures markets. It contrasts with a futures market in which delivery is due at a later date. But in forward market an agreement is for future. In the spot market the transactions take place in cash.

Price volatility drives the demand for hedging whether it is done via financial instruments such as futures contracts or options or via physical instruments such as inventories. Specifically the spot market or cash market is a public financial market in which financial instruments or commodities are traded for immediate delivery. Spot transaction is immediate but futures transactions pertain to a future date That is the basic difference between a commodity spot market and a commodity futures market. 6 Key Differences Between Spot and Futures Markets 1. It contrasts with a futures market in which delivery is. Cash market or otherwise known as spot market is one where the delivery of the underlying asset takes place immediately.

A Spot Market is the underlying market where assets are exchanged.

The first difference between commodity spot market and futures market is in the nature of pricing in the two markets. Therefore as opposed to spot markets forwardfutures markets make a contract today but settlement is expected in the future. An example of a spot market trade is when an investor Mr. It contrasts with a futures market in which delivery is due at a later date. The main difference between spot and futures prices is that spot prices are for immediate buying and selling while futures contracts delay payment and delivery to predetermined future dates. Jones wants to buy 1000 IBM shares on the New York Stock Exchange NYSE.