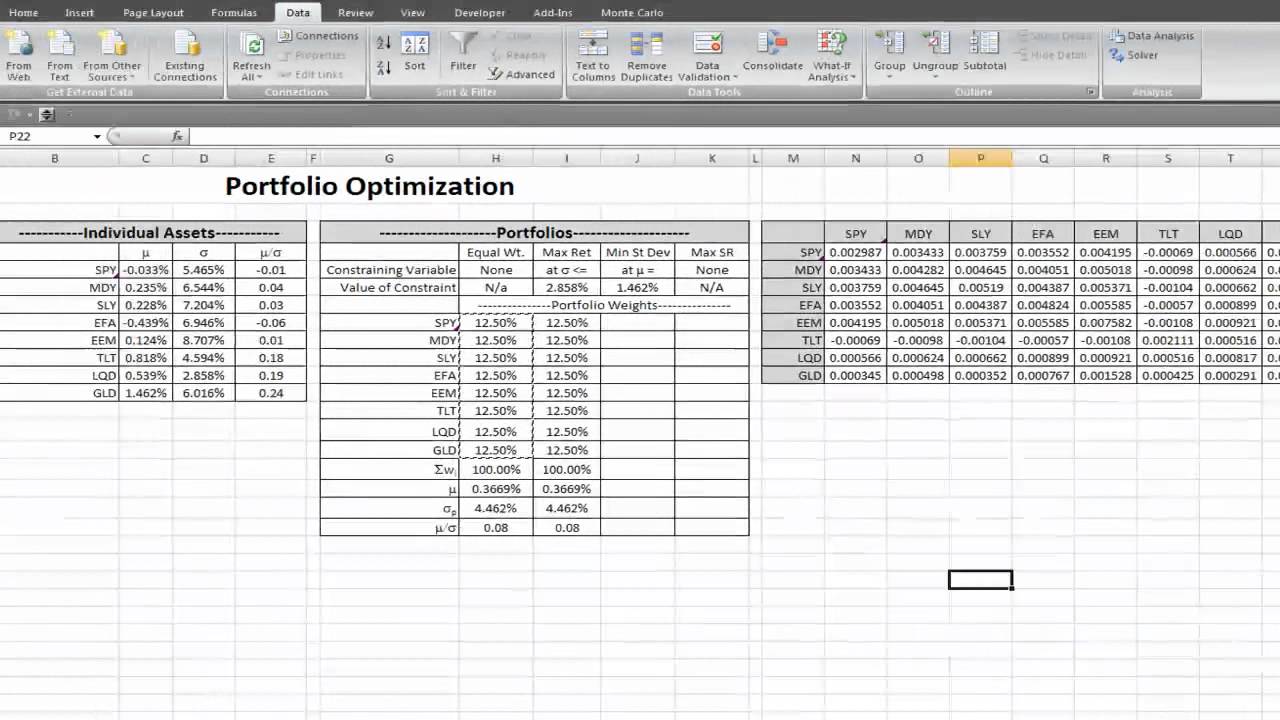

Optimal Risky Portfolio Excel Solver. Since the standard deviation of the risk-free asset. Duration or interest rate sensitivity serves as a proxy for risk. Colby Wright demonstrating how to use the matrix algebra and solver functions in Excel in order to optimize the weights within. Its equal to the effective return the actual return minus the risk-free rate of an investment divided by its standard deviation the latter being a.

In this note we show how it can be used to find portfolios that minimize risk subject to certain constraints. The best or optimal solution might mean maximizing profits minimizing costs or achieving the best. PortfolioanalysisOptimizing a portfolio of multiple assets in Excel using Solver. With these two worksheets as a basis we will use the Microsoft Excel Solver to model the complex Portfolio Optimization of more than 2 assets. This can be handled by creating a unit of yield for a unit of duration divide YTM by duration score for each bond. The complex formulas are calculated using Matrix equations and the optimal portfolio is determined using the Solver in Microsoft Excel.

An optimal portfolio – the portfolio which will provide the maximum return for the lowest unit of risk – is then estimated by maximizing the Sharpe ratio.

By contrast this book does nearly everything in plain vanilla Excel1 1 I have made two exceptions. A minimum variance portfolio and with the Pro-edition the portfolio which maximizes the geometric mean portfolio return are also produced. This is an instuction video on how to use Excels solver for calculating efficient portfolios. I suggest you read Instructions first. I made up the covariances in these workbooks for the purpose of demonstrating how to use Solver to find risk parity weights. Solvers or optimizers are software tools that help users determine the best way to allocate scarce resources.